Published July 9, 2021

CFOs must challenge supply chain and transportation leaders to help build stronger, more resilient transportation networks.

This article first appeared on CFO.com, authored by Leaf CEO Anshu Prasad along with Chris Gaffney and Mark Shaughnessy

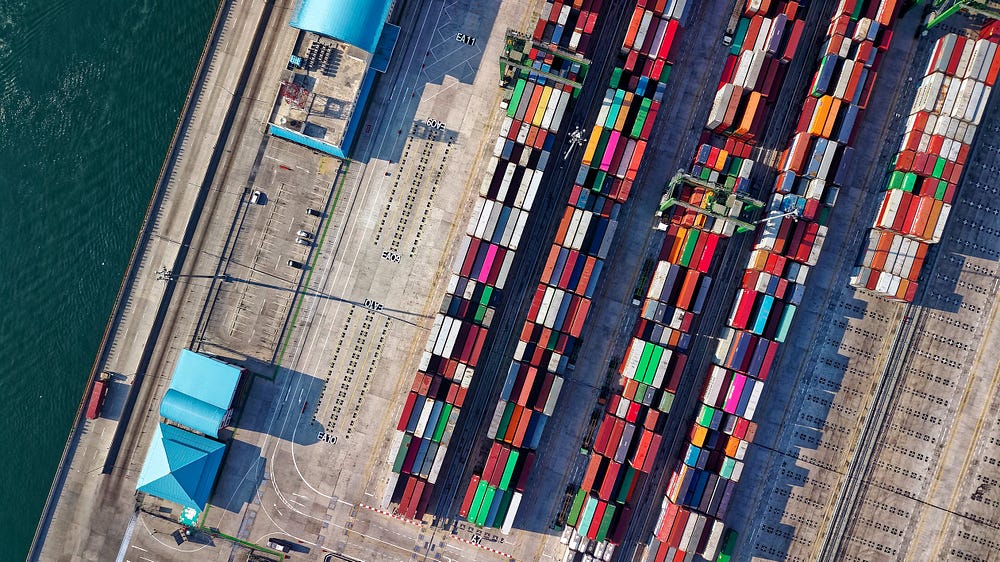

Transportation seems to be the topic of conversation more often these days. From shortages on our grocery store shelves for everyday items we previously took for granted, to the news of a large container ship stuck in the Suez Canal, to more recent news of disruptions in fuel supply in the Southeastern United States, it appears that transportation has suddenly become more volatile and less reliable.

For supply chain practitioners, however, transportation volatility has been a reality for some time. For decades, sophisticated shippers such as Walmart or Coca-Cola have maintained hundreds of relationships to manage the flow of products to stores and customers, requiring a patchwork quilt of solutions. For supply chain professionals, uncertain customer demand, production, and supply variability throughput require a mix of asset-based and asset-light providers. This mix of providers handles the unpredictable surges in transportation demand and requires supply chain professionals to focus entirely on execution with little thought given to the bigger picture of imagining an alternative.

Like in other parts of our economy, COVID-19 and the resulting economic shocks have forced supply chain practitioners and company executives to examine the frailty of their underlying transportation management infrastructure. Specifically, CFOs, many of whom have had to deal with significant transportation budget overruns this past year, are challenging their supply chain and transportation leaders to learn from these latest crises to build stronger, more resilient supply chains that will better serve the needs of their companies into the future.

Four key questions help shape conversations CFOs should have with their chief supply chain officers (CSCO).

1. How will our future supply chain better serve the changing needs of our customers?

More than a cost center, transportation is often critical to how a customer experiences a company’s product. Unreliable transportation often clouds the customer’s perception of the product they’re buying, putting future growth and margin in jeopardy.

Furthermore, as we strive to better serve our customers, we must also understand how their needs are changing, and how their expectations for faster and more reliable service are increasing. How well prepared to meet these rising demands are your transportation management teams, and the systems and providers you utilize?

What additional tools and data are you using today, beyond the RFP and backward-looking benchmark datasets, to meet these needs and not risk compressing your margins?

2. How can we better budget for transportation costs in an increasingly uncertain environment?

While we’ve previously endured cycles of heightened demand and corresponding budget overruns, these peaks and troughs seem to occur more frequently now.

How can we meet today’s demands while balancing investments in the tools and data we’ll need to manage our future supply chains?

Leading shippers have taken steps to take 10% out of their budgets for 2022 and onwards. They’ve done this by investing in technology to see their demand, and the broader network of supply, in a different way. New technologies have given shippers the tools to make deep analytical analyses of their network data to uncover and take advantage of better-matched supply.

3. How can we better manage through periods of volatility?

Our supply chains are interconnected with our suppliers and often extend geographically further than they have before. This means disruptions ripple through our supply chain and transportation plans, with shutdowns and restarts consuming weeks of our bandwidth. How can we be more responsive to changing patterns of demand and supply?

Historically, this volatility was addressed through excess inventory and capital. Today’s competitive landscape does not allow this and in many cases, the balance sheet solutions were not in the right time or place to adequately address volatility.

4. How can we hire, train, and retain the talent we’ll need to help manage a more data-driven supply chain?

Talented, innovative, and ambitious professionals will be attracted to transportation if it is perceived to be valuable to the company, and a driver of competitive advantage. They also want to see sustained investment in supply chain technology and digitization, accompanied by investments in their development and training to better use these tools to deliver value to the company.

To access the full article from CFO.com, click here.