Published November 3, 2018

The infamous trifecta of people, process and technology made dramatic strides since the mid 90’s in professionalizing sourcing in general, but particularly when applied to transportation. In the best cases, there is a true ambition to seek alignment between shipper requirements and the needs of the carriers’ networks. Though noble in concept and fruitful on paper, the entire theory often crumbles, and economic benefit dissolves over and over in practice. Shippers invariably revert to leverage-based strategies, flexing their buying power and forcing unsustainable rate concessions upon carriers. As a result, (1) relationships between shippers and carriers remain largely adversarial, (2) both parties spend inordinate effort to find loads / capacity, (3) empty miles persist and (4) unhappy drivers continue to leave the industry.

While leverage-based sourcing approaches have yielded results in neutral or shipper-friendly transport markets, today’s seller’s market requires shippers to think differently. To avoid abject failure in this year’s RFP, shippers need to employ more collaborative methods to effectively compete with other shippers for their carriers’ capacity. The strategies presented below all rely on shifting away from a “win — lose” leveraged-based approach to generate sustainable improvements in service and ensure cost reliability.

In a leverage-based world, a “take the good with the bad” strategy might have been lucky. But shippers must stop using this simplistic bullying tactic.

The shipper’s logic says the carrier is so grateful for the decent freight they are awarded, they are willing to absorb carrier unfriendly freight in return. In reality, the carrier recognizes this behavior and prices in the “dog freight”, either right away by padding pricing, or over time, by turning down your loads in favor of volumes he can consistently rely on. As a result, while expecting best pricing in proposal collection, the shipper ends up collecting average pricing plus fat. This is only a strategy for the lazy and/or satisfied with the status quo.

Understand that not all lanes make sense to a carrier. Seek carriers that have a real reason to run each lane. Award cats and dogs to niche specialists. Sure, this is more work, and might even result in dealing with a few more carriers. But, the payoffs in service and cost reliability more than justify the investment, especially in a tight capacity market.

In 20+ years of transportation sourcing, I recall only rare examples where the business awards provided enough specificity for the carrier to build a reliable network and asset plan. In general, shippers’ RFPs have said, “our annual volume is projected at 1,000 loads per year, but product demand will govern actual volume and that is not entirely in our control” or “average of 20 weekly loads, but customer orders will dictate the actual flow.” If asked for a more definitive commitment, the carrier is usually told “plan your equipment and find other work when I don’t need you is your business … just don’t screw up”.

Without a more reliable commitment, it is impossible for the carrier to plan a loaded move. The carrier has a better chance with a couple of days of notice to find a nearby load at destination, but even that leaves them exposed to the vagaries of the spot market and load boards. This lack of commitment is a big reason why empty miles are so high.

It is the carrier’s job to splice together a network that flows, but with no foresight on timing from their customer, their execution capabilities have evolved into nothing more than the ability to clear the deck the best they can today, then restarting their firefighting tomorrow.

Make a commitment. LE has analyzed over $9bn in shipper data, and found over 40% is reliable enough to make a day-of commitment right away. With a little upstream supply chain cooperation, that number can nudge up beyond 60%.

Over the years, shippers have gotten better at handing off significant blocks of increasingly cleaner baseline data. Many provide both summarized lane level data, along with massive amounts of shipment level history. Their typical thinking goes “I have given the respondents everything they could possible need to do a great job. They can analyze and price my lanes in a standalone manner, and bumping my data against their network to see what fits best to deliver me more aggressive pricing.”

Sidebar: During a break at a recent carrier conference I had just quoted the words above. The second largest carrier in the room came up and said, “what you said makes perfect sense, but when we get to the parking lot, we just laugh at you. We are great at clearing the decks, matching trucks to loads to cover today and tomorrow. We don’t have the people or the tools to do what you are suggesting.”

Pre-analyze the baseline and sell the business offered in the RFP:

Combined with “Practice 2” above, identify lanes that are eligible for a binding commitment on volume and emphasize the extra work done to make your freight more attractive than other shippers’. The RFP should be designed to command a separate price where there is attractive freight and the team is ready to make a binding commitment for capacity.

We all know that short notice and surprises are bad for the driver. Without reliable commitments and tendering in a spot or sporadic manner, the driver often deadheads to pickup locations, and scrambles to scour load boards while nearing a destination. Securing driver-friendly freight or simply figuring out how to get home for Johnny’s soccer game on Thursday night is next to impossible.

Clearly identify freight that can be made regular and plannable, and prioritize loading and unloading, similar to managing a dedicated asset. Planned freight should operate like clock-work. Let the folks that want to chase in the spot market be inefficient and chaotic. Position your reliable business as stable and profitable.

In this market, it is imperative your business is as attractive and simple as possible. Carriers are overwhelmed with the number and size of the RFPs they receive, and as described before, have limited horsepower available to analyze your volumes to develop a creative or differentiated proposal, especially in ‘bid season’.

Furthermore, offering a binding commitment on some of your volume will be new to the carriers. Given the vague promises from annual RFPs over the years, they might not trust your ability to deliver. And unless they’re familiar with running dedicated freight for you, they might not know how to price the commitment you’re offering, at least not right away.

Set up a program where any carrier that asks for help can get it. This does not mean help type in their response. But in much the same way comprehensive bid packages and carrier conferences allow for more aggressively priced proposals, helping carriers prepare more thoughtful responses will significantly enhance your bid process. What is their desired end game in this RFP? What type of business do they seek / want to avoid? Where are the soft spots in the networks they manage for other shippers? How will they manage your freight differently with the commitment you’re offering?

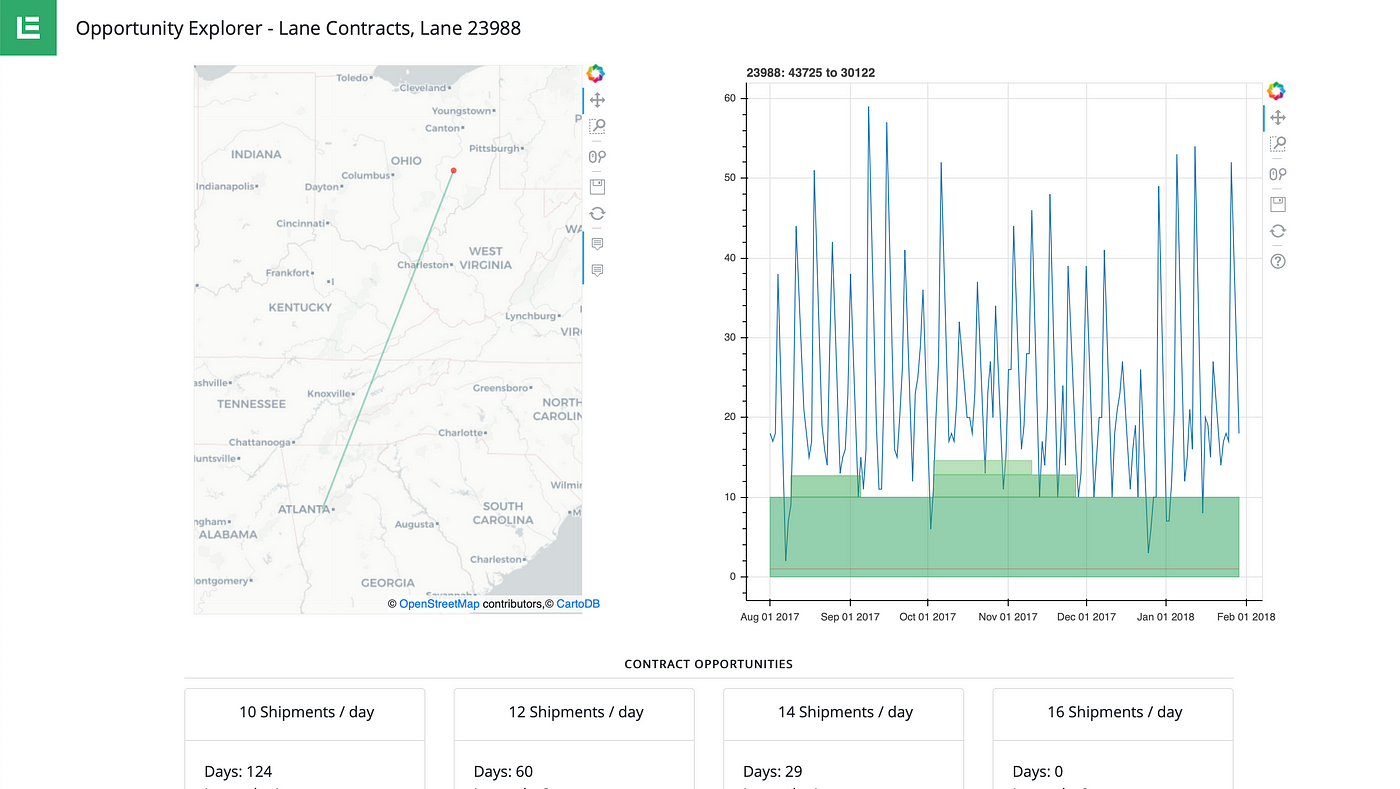

Our platform automates identification and execution of binding commitments, which are key for locking down reliable capacity at a reliable price

Over the last 20 years, we at LE have been building and enhancing approaches and tools to conduct annual RFPs. We believe future advancements lie in helping shippers and carriers improve their abilities to execute opportunities many have identified along the way. Our platform automates identification and execution of binding commitments, which are key for locking down reliable capacity at a reliable price. Our analysis spotlights freight that is plannable and desirable, in increasing amounts as data is added to our platform. We continue to work with our customers identify what can and should be planned. We are ready to support you at scale, and show you where you can start right away.